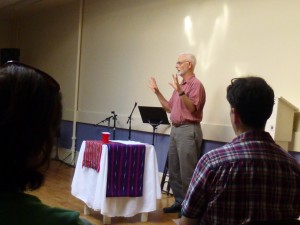

Above, Jim Campen, professor emeritus of economics at UMass-Boston and a former executive director of Americans for Fairness in Lending, discussed the flow of money, credit, goods and services through the economy at tonight’s general assembly.Campen spoke first and the photographer came in late, and so can’t provide much detail about his talk.

Fred Mosely, economics professor at Mt Holyoke College, reviewed the history of US banking, focusing on the insight that capitalism is inherently unstable without vigorous, active regulation. He appealed for a return to policies that would propel the government to nationalize failing banks and sack their dysfunctional boards of directors – rather than throw bailout money at them. Mosely also advocated for public state-owned banks, and listed their advantages as including:

• Acting as a ‘public option’ in banking whose presence helps to stabilize the whole banking system.

• Provide counter-cyclical lending to minimize recessions.

• Provide low interest rates on home mortgages and student loans.

• Can allocate credit to achieve social-eoconomic objectives such as affordable housing, green energy, health care, etc.